Helping You Increase Joy, Happiness, and Purpose By Removing Your Stress About Money

WHY DO YOU DESERVE MORE

You’re successful…

You’ve worked hard to acquire and keep what you have…

You understand there’s a deeper meaning behind your wealth…

The more successful you become and the more wealth you accumulate, the more complex the issues become.

At your level, you deserve more than a traditional financial advisor, or money manager… you deserve a fiduciary family office to simplify, consolidate, and coordinate a team of experts to help guide you through the complexities of your financial life.

We help successful entrepreneurs like you increase your joy, happiness, and sense of purpose by removing your stress about money. We help you get your entire financial life in perfect order and keep it that way forever.

CLIENT REVIEWS

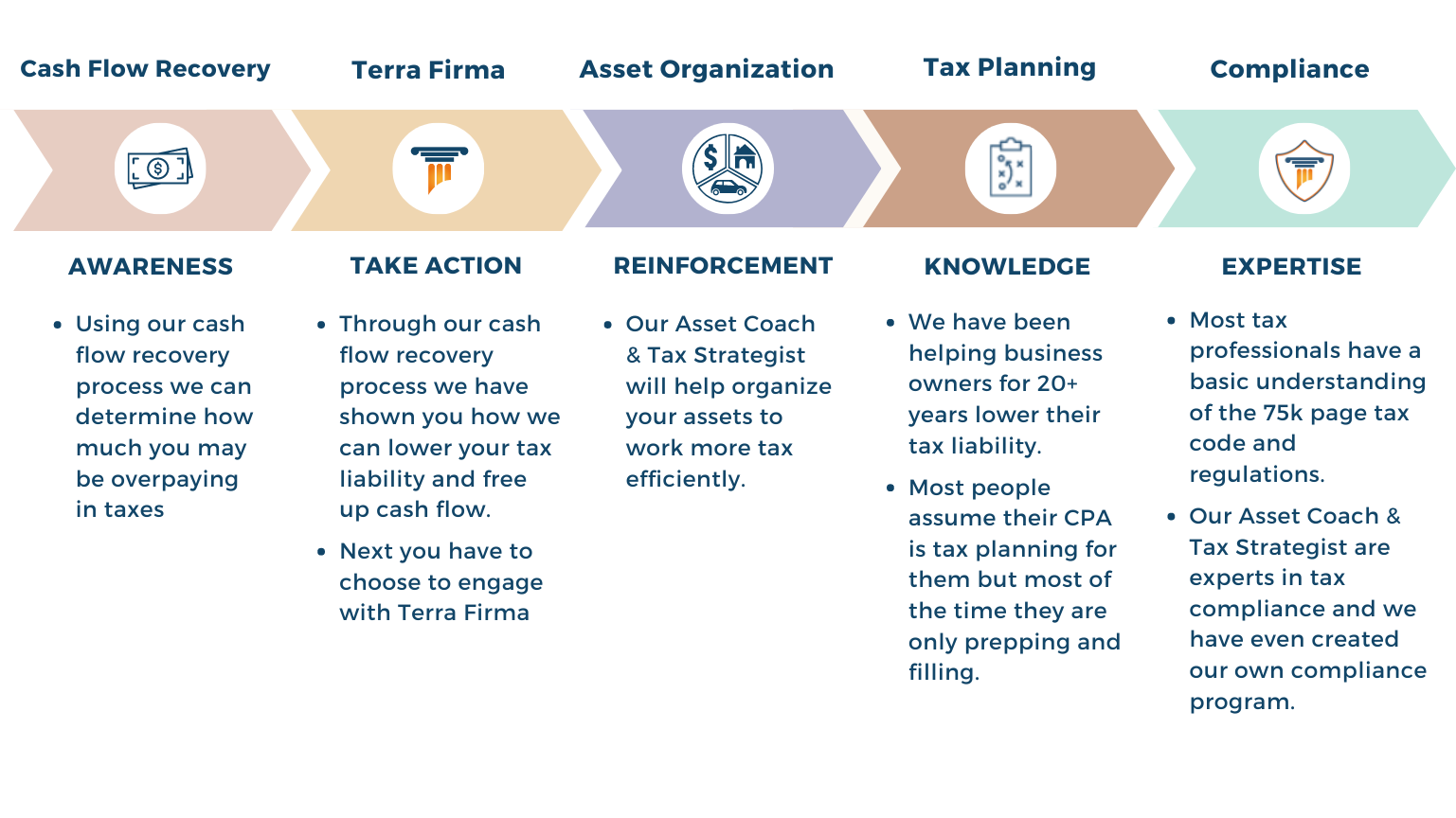

Let's schedule some time to find out how much you may be overpaying in taxes in only two questions.

WHO SHOULD YOU LISTEN TO?

NEWS & SOCIAL MEDIA

Financial entertainment news, social media posts, neighbors, friends, alarming phone alerts, other unlicensed experts and fake financial fortune tellers.

FINANCIAL/ INSURANCE SALESPERSON

Sales agents and sales brokers (acting like “advisors”), working at a bank or insurance company, charging commissions, bringing conflicts of interest.

ASSET COACH & TAX STRATEGIST

Completely independent and objective professionals, no commissions, held to a higher legal standard of fiduciary care in all advice given to you.

Increase your financial & lifestyle freedom to do more of what you love

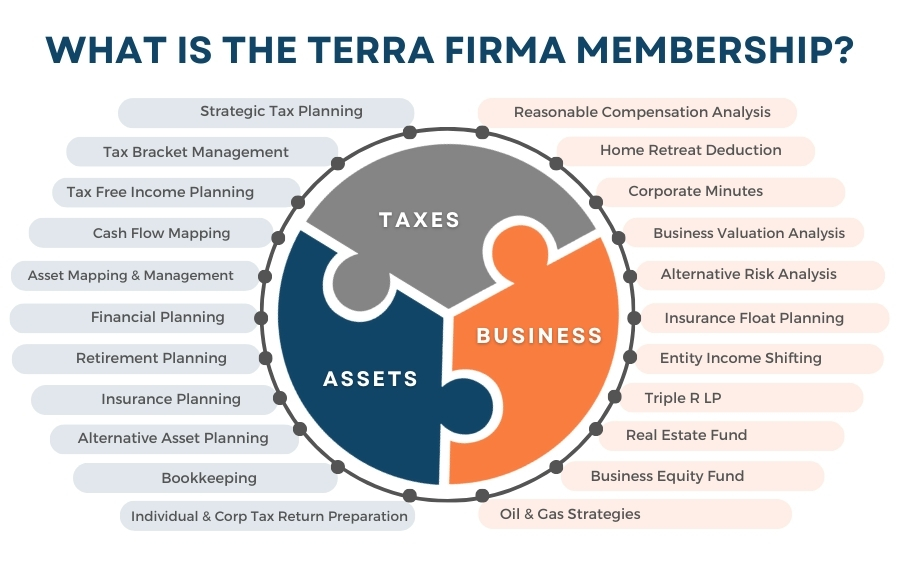

WHAT IS TERRA FIRMA MEMBERSHIP?

Terra Firma and our family of companies offer a large variety of services across the financial industry. So many that It may be hard to know what services you need in your current situation and that’s why we created the Terra Firma Membership. The membership is a holistic financial program that encompasses tax planning and compliance, wealth management, asset management, business consulting, and more. Through our ecosystem of companies we are able to better serve our clients and make sure there are no gaps left between the different professional advice you are receiving.

The membership is a comprehensive and structured plan for anyone aspiring to reduce their taxes and increase their wealth the way the wealthy do. Our membership will provide productive and valuable solutions to how and why you are reducing your taxes while building your wealth. Our goal is to empower you to take back full control of your financial situation.

OUR VALUE PROPOSITION

We will help you ALIGN your financial choices with your most important goals and most deeply held values.

You will have your entire FINANCIAL HOUSE in perfect order and we will keep it that way forever.

You will have TOTAL CONFIDENCE that no matter what happens in the markets, the world, or the economy you will be on track to accomplish your goals for the reasons that are important to you.

SIMPLIFY

CONSOLIDATE

COORDINATE

COMPREHENSIVE

ACCOUNTABILITY

“Terra Firma Business and Financial Consultants, LLC is a comprehensive consulting firm. Our goal is to assist our clients in determining the appropriate planning needs for today with flexibility to help determine possible exit strategies in the future. Our main goal is to educate you on the necessary strategic plans and designs that are available today to assist you in meeting your goals. We bring our expertise to inform and educate on the strategies available within the guidelines of your goals and objectives. We want to help you protect what you’ve worked so hard to earn and we are dedicated to accomplishing this goal!

All materials provided or communicated are not to be intended to be used, nor can it be used by any taxpayer for the purpose of avoiding U.S. federal, state or local tax penalties. Any taxpayer should seek advice based on the taxpayer’s particular circumstances from their own legal and tax advisors. Terra Firma Business and Financial Consultants, LLC and its consultants and/or affiliates do not provide legal or tax advice.

NOTICE: Nothing in this message should be interpreted as a digital or electronic signature that can be used to form, execute, document, agree to, enter into, accept or authenticate a contract or legal document unless otherwise expressly stated herein. This message and any attached documents contain information from the sender that may be confidential and/or privileged in nature. This message and any attached documents are intended only for the use of the intended recipient and any applicable privileges are not waived by virtue of this having been sent by e-mail. If you are not the intended recipient, you may not save, read, copy, distribute, or use this information in any way or for any purpose. If you have received this transmission but are not the intended recipient, please notify the sender immediately by reply e-mail and then permanently delete this message and any attached documents.

IRS CIRCULAR 230 DISCLOSURE: United States Department of Treasury Regulation Circular 230 requires that I notify you that, with respect to Federal Tax penalties only, unless expressly stated otherwise above, (1) You cannot rely on this advice for protection against Federal tax; (2) nothing contained in this message was intended or written to be used, can be used by any taxpayer, or may be relied upon for the purpose of avoiding any federal tax penalty under the Internal Revenue Code; and (3) nothing contained in this message may be relied on to support the promotion or marketing of any Federal tax transaction or matter that may be subject to Federal tax penalties. Any taxpayer may seek advice based on the taxpayer’s particular circumstances from an independent tax advisor with respect to any Federal tax transaction or matter contained in this message as it relates to Federal tax penalties.”